If you are scrolling through the endless abyss of scholarship applications, you’ve likely stumbled upon Scholly. Scholly made a splash on Shark Tank with its innovative approach to helping students secure financial aid for college. But what is the latest Scholly Shark Tank update?

In this guide, you will learn Scholly net worth and how a simple idea turned into a powerhouse of opportunity for students everywhere. So let’s crunch some numbers to uncover the financial evolution of Scholly after striking a deal with the sharks!

What is Scholly?

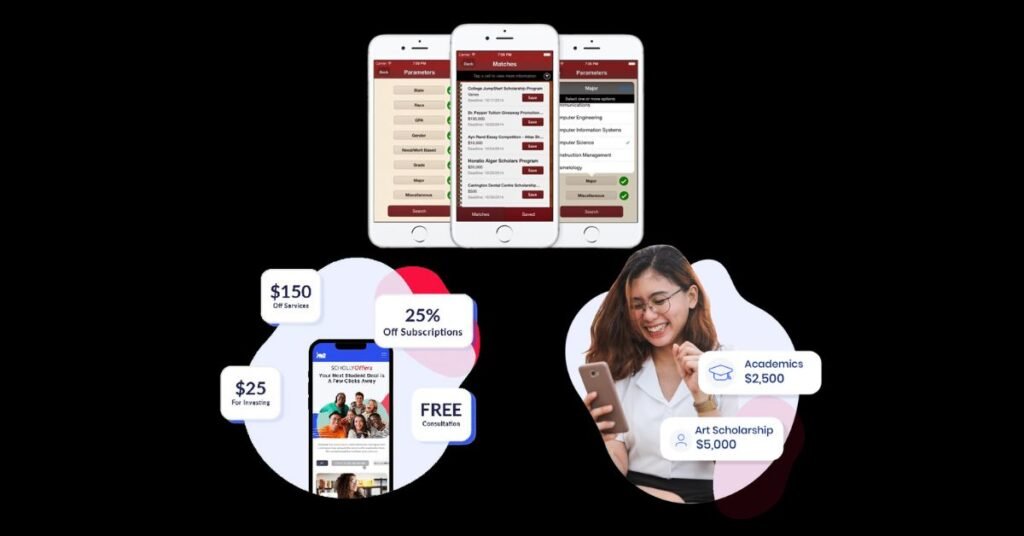

Scholly is a mobile app that assists students in finding and securing scholarships. The app utilizes advanced algorithms to match users with relevant scholarships based on their profile information, streamlining the often daunting process of scholarship hunting.

In Season 6, Episode 20 of Shark Tank, renowned investor Daymond John recognized the immense potential of Scholly and made a deal with Gray to develop further and scale the app. John’s investment in Scholly highlighted his keen eye for innovative solutions and signified the importance of supporting initiatives that enhance access to education.

Who Is Behind Scholly?

The man behind Scholly is Christopher Grey, alongside his co-founders, who took their app to the famed television show where they made a deal with Lori Greiner and Daymond John. While this deal cemented Scholly’s future, it also stirred up whispers among the other sharks.

Lori’s mention of friendship likely helped soothe some tensions but couldn’t erase the underlying unease that may have strained relationships in the tank.

Christopher Gray’s Early Life

Christopher Gray grew up in Philadelphia with his single mother. Under these challenges, he pursued his dreams of entrepreneurship and finance at Drexel University with unwavering determination. Through effort and relentless persistence, Gray secured an astounding $1.3 million in scholarships, showing his sheer willpower to overcome adversity.

Many of his peers struggled to find funding for their education, but Gray stood out by honing his skills in uncovering hidden opportunities and crafting winning applications. His success serves as a testament to the power of perseverance and resourcefulness, inspiring others to push boundaries and reach for their aspirations with confidence and resilience.

How Much Is Scholly Net Worth 2024?

Scholly shark tank net worth is $1.5 million because many people use its services. As Scholly grows, its value is expected to go up. The $1.5 million shows how Scholly helps students and schools with scholarships and financial aid.

This number shows that Scholly is dedicated to helping students succeed in school without money problems.

Learn about Kyle Rittenhouse, who was previously engaged in local police cadet programs, and is now studying at a College in the USA. Also, find out here what is Kyle Rittenhouse Net Worth in 2024!

Reason Behind Scholly

The reason behind Scholly is the vision of leveling the academic playing field. By offering $1.3 million in scholarships, Scholly doesn’t just provide financial aid; it ignites a spark of possibility for students facing economic hurdles. This app isn’t merely a resource—it’s a lifeline for those who may have felt education was out of reach.

Shark Tank Appearance

Chris Gray has a clear goal in mind, seeking $40,000 for a 15% stake, Gray confidently showcased how Scholly revolutionizes the scholarship search process for students. Lori Greiner’s immediate offer aligned perfectly with Gray’s ask, creating an exciting back-and-forth negotiation.

Daymond John also jumped in on the deal proposed by Greiner. The unity between these Sharks in securing a deal left Gray relieved and the Tank buzzing with anticipation. As three millionaires embraced this opportunity to invest in Scholly, each brought their unique perspective and enthusiasm to the table.

Lori Greiner and Daymond John Created Tension With Their Scholly Offer

Greiner and John played a strategic game. Herjavec left to avoid conflict with Greiner, showing the intense situation. Cuban and O’Leary were happy with investing in Scholly, showing different viewpoints among the Sharks. Some investors found Greiner and John aggressive, while others found it necessary for business.

Herjavec left to keep peace, while Cuban and O’Leary were confident in their investment, leading to success. The negotiations for Scholly on Shark Tank showed investors making deals and using different strategies. The clash of strategies highlighted potential successful collaborations.

Tension and frustration among Sharks like Greiner, John, Cuban, Herjavec, and O’Leary gave insight into each investor’s partnership style in the competitive world of entrepreneurship.

Scholly Closed The Deal After Shark Tank

Scholly struck a deal with investors Lori Greiner and Daymond John. The agreement made on the show was just the beginning, as finalizing deals like this can take months. The app became very popular after the show, thanks to both the investment and some drama during filming.

Despite some disagreements among the investors, Christopher Gray, the entrepreneur behind Scholly, remained calm and confident. This pitch helped Scholly become the top app on various stores, showing its potential in the education technology industry.

Scholly Is Available To Help You Find Scholarships

Scholly users were surprised when the app started charging fees after a free trial, causing frustration among students struggling with education costs. Users were also upset about reported app bugs, making them doubt the platform’s reliability.

Scholly defended the changes, saying a new update fixed the bugs and highlighted connecting students with over $100 million in scholarships. Finding scholarships is important for students to reduce financial burdens during college. Some may be put off by Scholly’s fees, but others may still benefit from the platform’s scholarship matching.

Scholly’s Next Steps (And a Shark’s Reflection)

Fixing tech problems is important for Scholly to do well. Daymond John and Lori Greiner believed in Scholly, even with tech issues. Mark Cuban and Robert Herjavec focus on tech, showing the need for a strong tech system.

Looking back on the 2015 pitch in 2022, John said Cuban and Herjavec’s tech knowledge may have influenced their decisions. Scholly stands out by offering detailed scholarships for a fee, even with competition from free databases. To stay competitive, Scholly could make applying for scholarships easier.

Revenue Streams and Business Model

Scholly changed its pricing from a one-time fee to a monthly subscription. This shows how businesses must balance making money and being available to everyone. The $0.99 fee at first made the app reachable to more people. But the switch to a $4.99 monthly subscription was to make more money and grow long-term.

Some users liked the new features from the subscription, while others worried about not being able to afford it. Businesses often have to find a way to make money while keeping their services affordable for everyone. The debate about Scholly’s pricing change shows how companies need to think about both making money and giving good services to all users.

Market Position of Scholly

The Scholly app stands out from competitors by offering a simple platform. The app matches users with scholarships that fit their profiles, making the process more personalized. This personalized approach sets Scholly apart in the crowded education technology market.

By meeting the unique needs of its users, Scholly has become a trusted resource for students seeking financial aid for their education.

Marketing Strategies Adopted by Scholly

Scholly has successfully implemented various marketing strategies to reach its target audience.

- They use targeted social media advertising to reach a younger audience who are likely to be interested in their scholarship platform.

- Collaborate with influencers and brand ambassadors to promote their services and connect with a larger audience.

- Utilizing data analytics, Scholly identifies trends and patterns in user behavior to tailor their marketing strategies for maximum impact.

- By offering exclusive discounts and referral programs, they incentivize current users to spread the word about Scholly, creating a powerful word-of-mouth marketing effect.

- Leveraging partnerships with educational institutions, Scholly establishes trust and credibility within the academic community.

Scholly Social Media Presence

Scholly is creating a buzz in the student community with a vibrant social media presence across Instagram, LinkedIn, and YouTube. Boasting 46.6K followers on Instagram and thousands more on Linkedin, Scholly has built a strong online community. They also have a YouTube channel.

Scholly’s Website is a goldmine for savvy students looking to discover exclusive student deals from popular brands. From discounts to resources, Scholly has positioned itself as the go-to platform for all things related to saving money and accessing valuable student resources.

Concluding “How Much Is Scholly Net Worth?”

Scholly helps countless students to access opportunities for higher education. As Scholly continues to grow and evolve, its impact will only become more apparent. Next time you use Scholly or hear about its success stories, remember that its true worth goes beyond mere financial value – it’s about changing lives and shaping futures.

Frequently Asked Questions

How Much Did the Sharks Invest in Scholly?

The sharks gave $40,000 to Scholly on Shark Tank. That investment grew to $30 million in revenue. Daymond John invested in Scholly in 2015 and it paid off. Small investments can lead to big success.

Who Is The CEO Of Scholly?

Christopher Gray is the CEO of Scholly! He’s the brains behind this innovative platform that helps students find college scholarships.

Where Is Scholly Headquarters?

Scholly’s headquarters can be found at 3220 Market St in Philadelphia! Yep, that’s right in the heart of the city of brotherly love.

Who Acquired Scholly?

Sallie Mae acquired Scholly back in 2019. It was a big move that brought together two major players in the education financing and student support space.

Why Did The Sharks Fight Over Scholly?

Because the Sharks wanted to make sure it could help more students without losing quality. Greiner, on the other hand, didn’t seem worried about scholarships. She might have had a different view of Scholly’s potential success. The sharks’ argument over Scholly shows their interest in investing in impactful ideas.